Saudi Family Offices

Saudi Family Offices

Saudi investors of Aljazira and consortium invested $350 million in US firm

Saudi investors of Aljazira and consortium invested $350 million in US firm

Saudi investment firm Aljazira Capital and a consortium has acquired stake in Axiom Space, a US firm for $350 million.

Saudi investment firm Aljazira Capital and a consortium has acquired stake in Axiom Space, a US firm for $350 million.

Founded in 2016, Axiom Space has completed the first private mission to the International Space Station and it is also currently building the first commercial space station. It is led by Michael Suffredini, who served as NASA's International Space Station Program Manager from 2005 to 2015. (Founded in 2008 and based in Riyadh Saudi Arabia, Aljazira Capital is a financial investment firm that invests regionally in startups like Floward and Tarabut and internationally)

Aljazira Capital is listed in the Middle East Investors Directory with the code AU85.

Three Middle East investors among 18 investors helping Musk Twitter buyout

Three Middle East investors among 18 investors helping Musk Twitter buyout

Three Middle East investors are among 18 investors that are helping Elon Musk securing a total of $7.14 billion to fund his $44 billion takeover of Twitter - according to a SEC filing just released.

Three Middle East investors are among 18 investors that are helping Elon Musk securing a total of $7.14 billion to fund his $44 billion takeover of Twitter - according to a SEC filing just released.

Dubai Vy Capital is investing $700 million, Qatar Holding is investing $375 million. Saudi investor Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud (Kingdom Holding Company) is committing 34,948,975 of his Twitter Inc shares in the new company (valued at $54.20 per share).

Kingdom Holding Company is listed in the Middle East Investors Directory with the code BFD84. Vy Capital with code JL48, Qatar Holding with code LIP09

Saudi family offices announced investing in cryptocurrency firm Vertex ICO

Saudi family offices announced investing in cryptocurrency firm Vertex ICO

A group of Saudi investors announced investing in Vertex ICO, a blockchain start-up.

A group of Saudi investors announced investing in Vertex ICO, a blockchain start-up.

Vertex is creating a market and a token that combines trading, venture capital experience, and fair-value based tokenization. Vertex also offers an aftermarket for ICOs, which will provide investors with opportunities to get returns and bring more fiat resources into cryptocurrency markets. (Among investors in the Vertex ICO you can find arab investors like Naif Al Rajhi, Abdullah Al Othaim, Bander Al Rajhi and Abdulaziz Bin Sultan). More details here.

To see a list of angel investors from Saudi Arabia similar to Abdullah Al Othaim, check the Middle East Investors Directory.

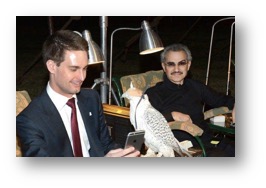

Saudi family office of Alwaleed Bin Talal acquired 2.3% stake in Snapchat for $250 million

Saudi family office of Alwaleed Bin Talal acquired 2.3% stake in Snapchat for $250 million

Saudi Prince Alwaleed Bin Talal, founder of Kingdom Holding investment firm, bought 2.3% stake in American technology and camera company Snapchat for $250 million.

Saudi Prince Alwaleed Bin Talal, founder of Kingdom Holding investment firm, bought 2.3% stake in American technology and camera company Snapchat for $250 million.

The shares was bought at around $11 each, below the $13.10 price shares closed at before earnings were released. Alwaleed and Kingdom holding has investment in other technology companies such as Lyft, JD.com and Twitter. (More details here)

Kingdom Holding is listed in the Middle East Investors Directory with the code BFD84.

VC arm of family office Almajdouie Holding invested $1.4 million in Trukker

VC arm of family office Almajdouie Holding invested $1.4 million in Trukker

Saudi venture capital firm Raed Ventures and a consortium have invested $1.4 million in UAE online truck aggregator Trukker.

Saudi venture capital firm Raed Ventures and a consortium have invested $1.4 million in UAE online truck aggregator Trukker.

Founded in 2016, Trukker is deemed as the "UBER of trucks". They have a tech-enabled trucking network where their clients can make a booking using their website and mobile applications. The Dubai-based company is currently working on establishing their business in the Eastern and Western regions of Saudi Arabia. (Established in 2015 by Almajdouie Holding LLC, Raed Ventures specializes in investments like seed and early stage, prioritizing startups in the fintech sector in Saudi Arabia and MENA region.)

To see a list of investors from Saudia Arabia similar to Raed Ventures, check the Middle East Investors Directory.

Saudi family office of Bugshan acquired stake in a blockchain startup for $820,000

Saudi family office of Bugshan acquired stake in a blockchain startup for $820,000

Saudi angel Investor Ahmed Abdullah Bugshan, a board member of the Arabian Bugshan Group has invested $820,000 in blockchain startup ArabianChain

Saudi angel Investor Ahmed Abdullah Bugshan, a board member of the Arabian Bugshan Group has invested $820,000 in blockchain startup ArabianChain

ArabianChain, a public blockchain in the Middle east, is founded by Mohammed Alsehli and Walid Messaoudi. It will have two distinct features: DBIX, a cryptocurrency in the region to enable payments and money transfer, and Thuraya, a soon-to-be launched smart contracts programming language in Arabic. (The investor, Ahmed Abdullah Bugshan, is a board member at the Arabian Bugshan Group with interests in construction, electrical, automobiles, cosmetics, real estate and more. He is also the CEO of the House of Invention International.)

To see a list of angel investors from Saudi Arabia similar to Eng. Ahmed Abdullah Bugshan, check the Middle East Investors Directory.

Saudi family office of Abuljadayel acquired stake in UK media firm The Independent

Saudi family office of Abuljadayel acquired stake in UK media firm The Independent

Sultan Mohamed Abuljadayel, a 42 years old Saudi national, has acquired stake in the famous British newspaper The Independent for a reported sum of $130 million.

Sultan Mohamed Abuljadayel, a 42 years old Saudi national, has acquired stake in the famous British newspaper The Independent for a reported sum of $130 million.

Established in 1986, the Independent was controlled by Tony O'Reilly's Independent & Media from 1997 until Russian oligarch Alexander Lebedev invested in it in 2010. Sultan Mohamed Abuljadayel, 42, listed in company records as a Saudi-based Saudi Arabian national and has acquired up to 50 percent of the Independent. According to Middle East Eye, a source with knowledge of the deal said the investment may be as much as $130 million.

To see listing and email addresses of investors from Saudi Arabia similar to Sultan Mohamed Abuljadayel, check the Middle East Investors Directory

More details follows:

Saudi family office of Tamer and consortium invested $160 million in French firm Sigfox

Saudi family office of Tamer and consortium invested $160 million in French firm Sigfox

Saudi investment firm Tamer Group and a consortium of investors have invested $162 million in Sigfox, a provider of connectivity for the Internet of Things.

Saudi investment firm Tamer Group and a consortium of investors have invested $162 million in Sigfox, a provider of connectivity for the Internet of Things.

Established in 2009, Sigfox builds wireless networks to connect low-energy objects such as electricity meters, smartwatches, and washing machines, which need to be continuously on and emitting small amounts of data. It currently has 10 million objects registered on its network and coverage currently spanning 26 countries. (Tamer Group is a healthcare, beauty care, and fast moving consumer goods company headquartered in Jeddah, Saudi Arabia)

Tamer Group is listed in the Middle East Investors Directory with the code SINO92.

More details follows:

More from Saudi Family Offices ...

Saudi family office Al Sanie invested $7 million in travel website HolidayMe

Saudi family office Al Sanie invested $7 million in travel website HolidayMe

The National Geographic article on Saudi Al Shiddi Family Office investments in Europe

The National Geographic article on Saudi Al Shiddi Family Office investments in Europe

Saudi Bin Talal family office acquired 50% stake in Romanian engineering firm

Saudi Bin Talal family office acquired 50% stake in Romanian engineering firm

Nasr El Hage Jr and family offices has big plans for US real estate in DC

Nasr El Hage Jr and family offices has big plans for US real estate in DC

About Us

About Us

Established in 2007, DubaiBeat.com provides insight, analysis and research on Middle East investors.

We cover different asset class investors like private equity, venture capital, hedge funds and real estate investors from the Middle East and broader MENA region.

Recent Investments

Recent Investments

-

Saudi family offices of Watar Partners co-invested $700 million in NY food business

(7 days ago - investor code in database: AJ27) -

Dubai Investors of Oraseya co-invested $5.5 million in Boston firm

(14 days ago - investor code in database: JU24) -

Abu Dhabi Investors of IMI co-invested $158 million in UK firm The Very Group

(16 days ago - investor code in database: JU14) -

Dubai Investments acquired stake in UK digital bank Monument

(investor code in database: OR191) -

Saudi VC Prosperity7 led investment of $14 million in Chinese firm

(investor code in database: BJ96) -

Saudi investors of Aramco Ventures invested $20 million in US firm

(investor code in database: BS15) -

Saudi investors of Aljazira and consortium invested $350 million in US firm

(investor code in database: AU85) -

Dubai Panthera Capital and consortium invested $22 million in Indian startup

(investor code in database: SE15) -

Qatar investors of QIA and consortium acquired stake in German software firm for $400 million

(investor code in database: BD44) -

Saudi VC firm Prosperity7 led investment of $35 million in Hong Kong firm

(investor code in database: BJ96)